how to find bull flag stocks

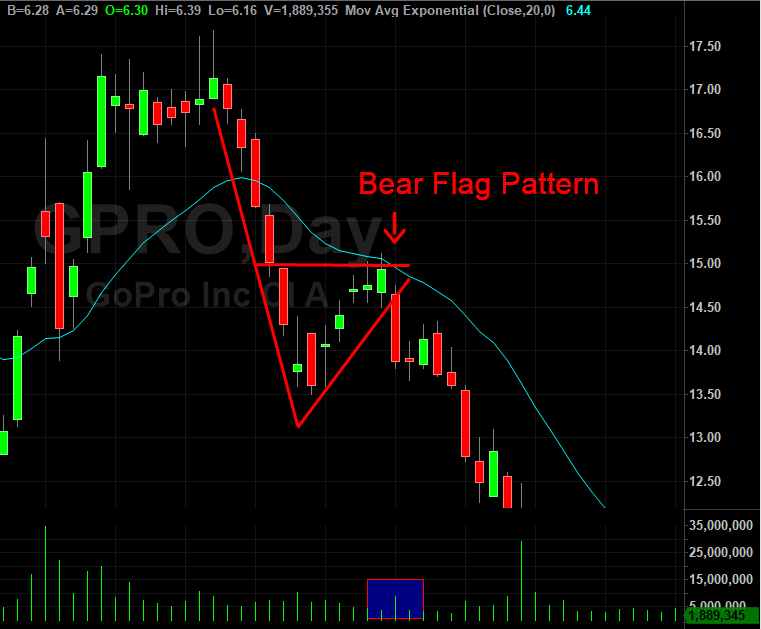

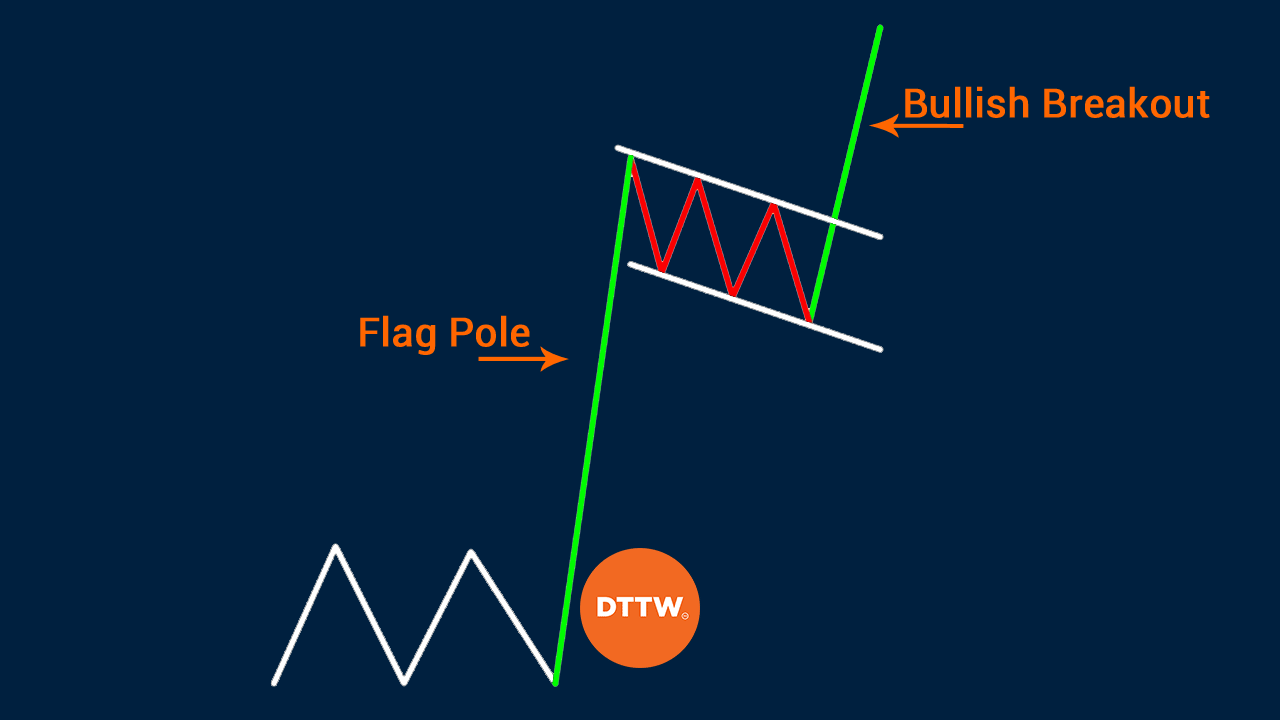

Look for a strong trending move higher. A bull flag is a technical continuation pattern which can be observed in stocks with strong uptrends.

How To Trade Bullish Flag Patterns

Ad 874 Proven Accuracy.

. Key things to look out for when trading the bull flag pattern are. Screening for Intraday BULL Flags on Indian Stock Market. The first entry is on the flag break and the second potential entry is on the break of the high of the flagpole.

I think the cattle market is divided into two environments. The closer in encompasses ample inventory with improving weights and a stressed consumer into August. Preceding uptrend flag pole Identify downward sloping consolidation bull flag.

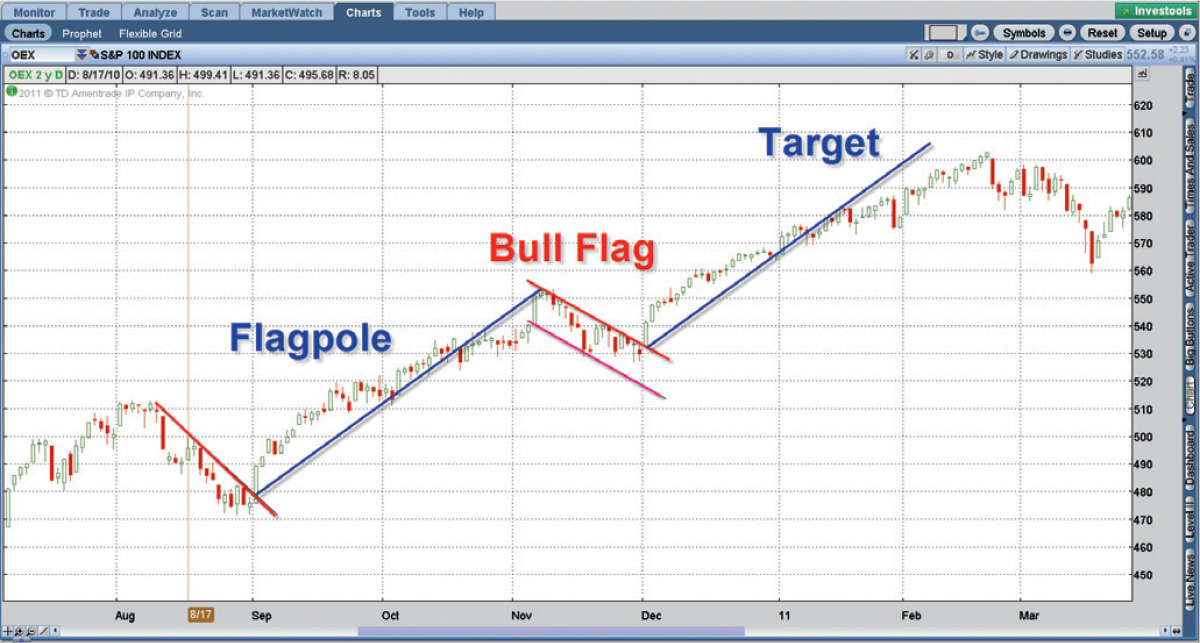

In this video youll learn how to identify a bull flag pattern how its used to determine potential buy signals and price targets and the risks and goals. Flags and pennants require evidence of a sharp advance or decline on heavy volume. Look for a strong trending move This means the range of the candles are more bullish than usual and they tend to close near the highs.

I was trying to do 1yr 1day but it doesnt have it. You can find them in all shapes and sizes and they can be most easily seen using the daily chart. RUN IN STOCK SCREENER.

When you see the graphical representation of this pattern youll notice that it. Its screener has built in predefined function that can find stocks with Flags or Pennants. Today stock must close above both its 10-day and 50-day moving averages.

So as a flat top breakout consolidates within a few cents of the highs a bull flag pattern experiences typically 2-3 red candles of pullback and can even pullback to the faster moving averages like the. To trade this strategy on stocks with NSE you need the below setup to identify bull flag pattern while they are still forming. Stocks On Fire.

Using Investar Stock Screener. You may say its a bull flag. Ad Time-saving market tested algorithm designed for an edge in the market.

Improve performance with simplified signals on technical patterns. Once the pole is found identify the range of consolidation or wavering in the price of the stock this is the flag. And the rally needs high volume.

Heres how to spot one. 14 hours agoPrice action today helped to confirm there was little to anticipate. 706 This screen finds bull flag patterns.

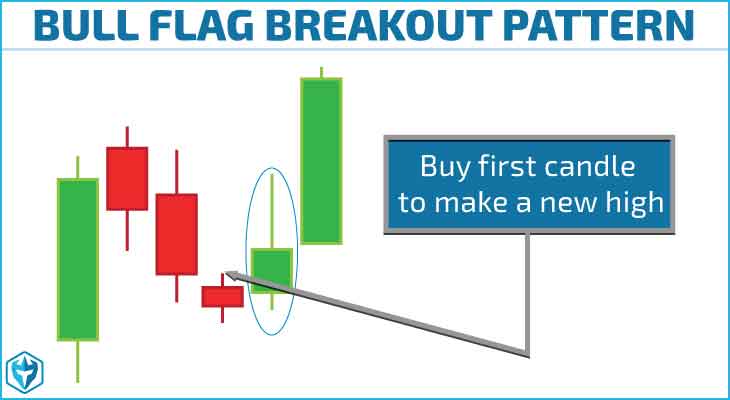

When I trade a bull flag stock pattern the biggest difference from a flat top breakout is that the consolidation is occurring BELOW the high. Step 3The retracement should not be less than 38 and its not a bull flag even if it is below 50. The first entry is on the flag break and the second potential entry is on the break of the high of the flagpole.

The bull flag pattern is suitable for all kinds of assets but is most commonly used as a continuation pattern for stocks. A bull flag is a continuation chart pattern that signals the market is likely to move higher. If the flag portion of the pattern develops a consistent downtrend its often called a bull pennant pattern because the flag has a triangular shape.

Screening for Intraday BULL Flags on Indian Stock Market. When you couple them with moving averages like the 9 and 20 exponential moving averages you can have a pretty good formula for trading. A bull flag is a technical continuation pattern which can be observed in stocks with strong uptrends.

Todays close must be in the top 25 of the daily range. Bull flags can be found on any time frame you use for trading. A follow-up rally is likely when combined with other bullish indicators.

The bull flag should have an uptrend since its a continuation pattern and isnt a reversal. The first step in identifying the pattern is to locate the pole which is representative of a significant rise in the stock price and is the starting point in the formation of the pattern. 1 Investar software 5.

Stay tuned for my 3 st. Coupling these different tools make for a clearer picture. The bull flag is an easy-to-learn pattern that shows a lull of momentum after a big rally.

Bullish flag formations are found in stocks with strong uptrends and are considered good continuation patterns. Today we talked about screening stocks and finding good bull flag patterns. The price of the stock often surges 15 30 50 even 100 or more out of this pattern.

After the strong move higher the market needs to take a break. Draw lines parallel to the pattern. Yesterdays close must be in the bottom 25 of the daily range.

Trading The Bull Flag Pattern Letss zoom in on the chart below and add some trend lines to make it easier to figure out where our safest entry point is. The pattern takes shape when the stock retraces by going sideways or by slowly declining after an initial big rise in price. When I tested scan for bull flag pattern in stocks with average volume above 300K returned only five results as you can see below.

This means the range of the candles are more bullish than usual and they tend to close near the highs. What would be the best time frame option for that scan for swing trading. Its easy to spot them in hindsight but much harder in the moment.

Hey everyone what are your thoughts on this type of video. But today it can be different. It consists of a strong rally followed by a small pullback and consolidation.

Experience the Power of Artificial Intelligence. Bull flags are fire - I have had. There are two spots of entry on any flag formation when playing for the trend continuation break.

They are pretty rare outside of penny stocks which tend to be less reliable. They are called bull flags because the pattern resembles a flag on a pole. RUN IN STOCK SCREENER.

Tomorrow buy 10 cents above todays high. Heres where you can expect a potential Bull Flag to form as the market does a pullback. After the strong move higher the market needs to take a break.

You gotta study charts so you can learn to recognize them in the heat of the moment. Add a new filter for Pattern and you can select FLAG. When the correction begins and the price drops.

Heres what to spot one. Open An Account And Start Trading Forex Like A Pro Today With The 1 US FX Broker. Our 40 Years Of Experience Speaks For Itself.

They are called bull flags because the pattern resembles a flag on a pole. The pattern takes shape when the stock retraces by going sideways or by slowly declining after an initial big rise in price. When you see the graphical representation of this pattern youll notice that it somehow looks like a flag on a pole.

To trade this strategy on stocks with NSE you need the below setup. The bull flag pattern is one of the preferred setup traders like to use before the price of a security rises. Moving average crossovers on any time frame supply important buy and sell signals.

This pattern is one of the simplest to spot on a price chart and the success rate is very high compared to other price action indicators. Ad Empowering FX Traders In The Worlds Largest Traded Market For Over 20 Years. You can use other properties to dial it in.

Rules via Hit Run Trading.

Bull Flag Chart Pattern Trading Strategies Warrior Trading

Bull Flag Price Action Trading Strategy Guide 2022

Bull Flag Trading 12 Epic Tips Trading Strategies

Bull Flag Chart Pattern Trading Strategies Warrior Trading

A Market Signal Bull Flags Ascending Triangles And Ticker Tape

Learn About Bull Flag Candlestick Pattern Thinkmarkets En

Bullish Flag Chart Patterns Education Tradingview

Learn About Bull Flag Candlestick Pattern Thinkmarkets En

Stock Charting Tips Leading The Charge With Bull Fla Ticker Tape

Bull Flag Chart Pattern Trading Strategies Warrior Trading

How To Trade Bullish Flag Patterns

Bullflags Education Tradingview

Bull Flag Chart Pattern How To Use In Trading Libertex Com

How To Trade Bull Flag Pattern Six Simple Steps

What Is Bull Flag Pattern How To Identify Points To Enter Trade Dttw

Are You Taking Advantage Of These 3 Bull Flag Patterns

:max_bytes(150000):strip_icc()/dotdash_Final_Flag_May_2020-01-337783b3928c40c99752093e6cb03f6d.jpg)